This owner’s draw would reduce Mr. A’s share capital invested in the business. For instance, if a sole proprietor is using house space for office work, it should be rented to the business at market-competitive rates. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. Using this logical approach, it should be possible to identify which accounts will be affected and then consider how they will be affected. Similarly, in the world of online gaming, players are always looking for online slots big wins. Choosing high-RTP slots, playing progressive jackpots, and utilizing free spins and bonus features can increase winning potential. Many online casinos also offer special promotions and tournaments, giving players even more chances to land massive payouts.

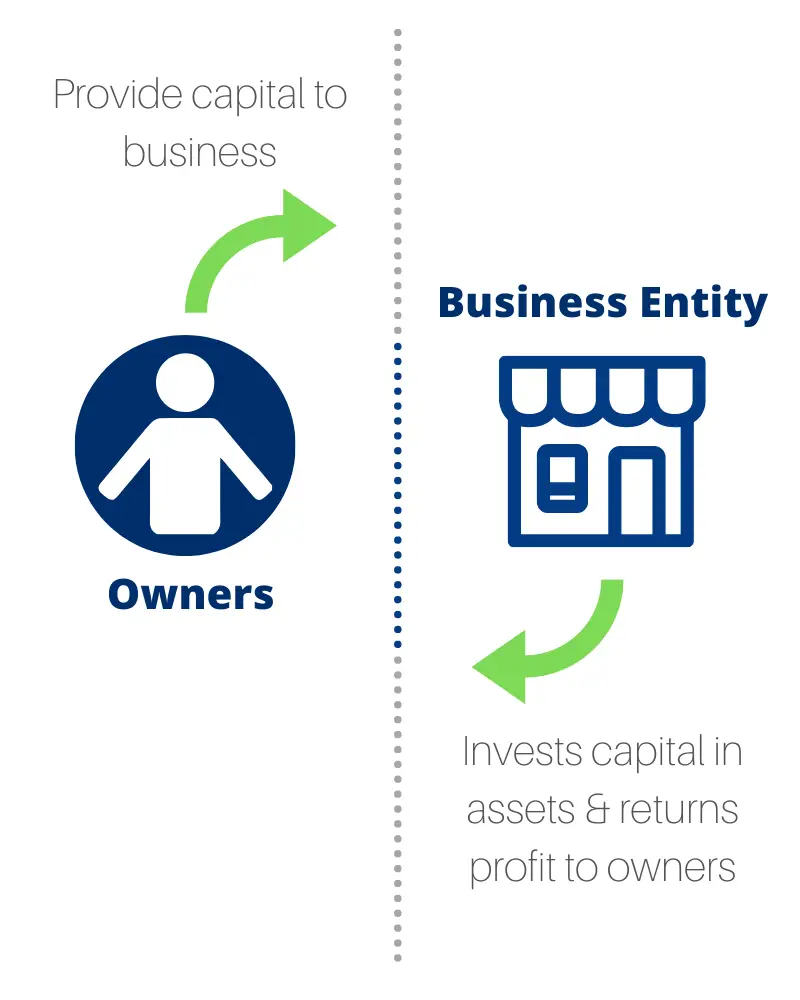

What is the relationship between owners and business entities?

If you use your personal credit card for your business, that will be counted as a loan or additional capital. Different forms of partnerships like LLCs and LLPs have limited liability protection. A sole proprietorship is the simplest business structure and doesn’t require any legal forms in order to create. There is only one owner who is unlimitedly liable for all the company’s actions. With the business entity concept in play, there is a clear distinction between related businesses and your personal life. Having a mixed and joint financial record of your business and personal expenses makes it relatively difficult for external auditors to separate these two transactions from each other.

Income Statement Under Absorption Costing? (All You Need to Know)

This means that types of business entities should be changed if they are no longer suitable, and the main criteria are to choose types that will always fit your company regardless of the situation. Before making any decision on what type of entity you wish to choose for your company, it is highly recommended to consult with a professional tax adviser or an attorney. In other words, failure to understand cash flow from assets calculator the types of business entities available and the rules that apply to them will place your business at risk. There are various types of business entities out there, and each one is suitable for certain types of businesses. Expense on education that is necessary for self-employed owners to improve their knowledge and understanding of their trade is considered a business expense in accounting.

Get Any Financial Question Answered

When applied at levels, the business entity concept can avoid audit errors that could prove costly otherwise. Here are a few important points when applying the business entity concept. Each financial transaction should be recorded with a reference to the usage of the business or owners.

The historical cost of assets and liabilities will still be updated over time to depict accounting transactions like depreciation or the fulfilment of part or all of a liability. But it will not be updated to reflect the current value of a similar asset or liability which might be acquired or taken on. Choosing a business entity is one of the first steps that a business should take.

- Having a mixed and joint financial record of your business and personal expenses makes it relatively difficult for external auditors to separate these two transactions from each other.

- However, once you understand the concept of business entity in accounting, you will find it is quite easy to record transactions from the perspective of the business.

- The Conceptual Framework refers to a ‘reporting entity’ which is an entity that is required, or chooses, to prepare financial statements.

The business entity can be an adequate check and balance mechanism to track owners’ actions concerning the company’s funds. Business owners aim to generate profits from a business by utilizing resources efficiently. The business concept helps them achieve their goals of improving business performance. This is the entity structure where two or more persons (or entities) are owners of a business. We can explain the business entity concept with the help of a few simple examples. This will keep a fair accounting record of the business as well as compliance with the taxation and regulatory requirements.

Study with us and you’ll be joining over 2 million students who’ve achieved their career and personal goals with The Open University. Enrol and complete the course for a free statement of participation or digital badge if available. Anyone can learn for free on OpenLearn, but signing-up will give you access to your personal learning profile and record of achievements that you earn while you study. Ask a question about your financial situation providing as much detail as possible. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos.

This was that Andrea agrees to buy goods from Brian on 25 January and Brian agrees that Andrea can wait until 25 March to pay for the goods. This does not mean that everything in the accounts needs to be treated the same by every entity. Candidates in FA2 will not be required to decide on an appropriate cut off level for materiality. This is a more advanced issue, which requires the exercise of professional judgment. There are some key issues within this definition that candidates should be aware of. While an awareness of what is meant by ‘a different basis’ might be expected (for example, break up basis), candidates would not be expected to apply that basis to calculate values in the FA2 exam.

In addition, if Andrea withdraws money for personal expenses, the nature of the expense is not recorded. All that is necessary is to record the fact that Andrea withdrew funds – with a debit entry in the drawings account and credit entry in the bank account. You can choose whether it’s treated as a corporation or as a pass-through entity for tax purposes. LLCs can have one owner (referred to as a “member”) or many, so it’s a useful alternative to a sole proprietorship for freelancers and other individual business owners. In accounting, it is important to differentiate between business and personal transactions because you only want to record those transactions in financial statements that relate to a particular organization.

Instead, he should charge only one-fourth of the rent ($1000) as a business expense. The remaining amount ($3000) is his personal expense that has nothing to do with his fitness training business. It allows for evaluating the performance of different business segments or divisions using distinct metrics. The main disadvantage of a corporation is that it is subject to double taxation, as both the profits made by the corporation and the dividends received by shareholders are subjected to tax. A general partnership involves an agreement between two or more people, each contributing a significant amount of the capital required to run the business.