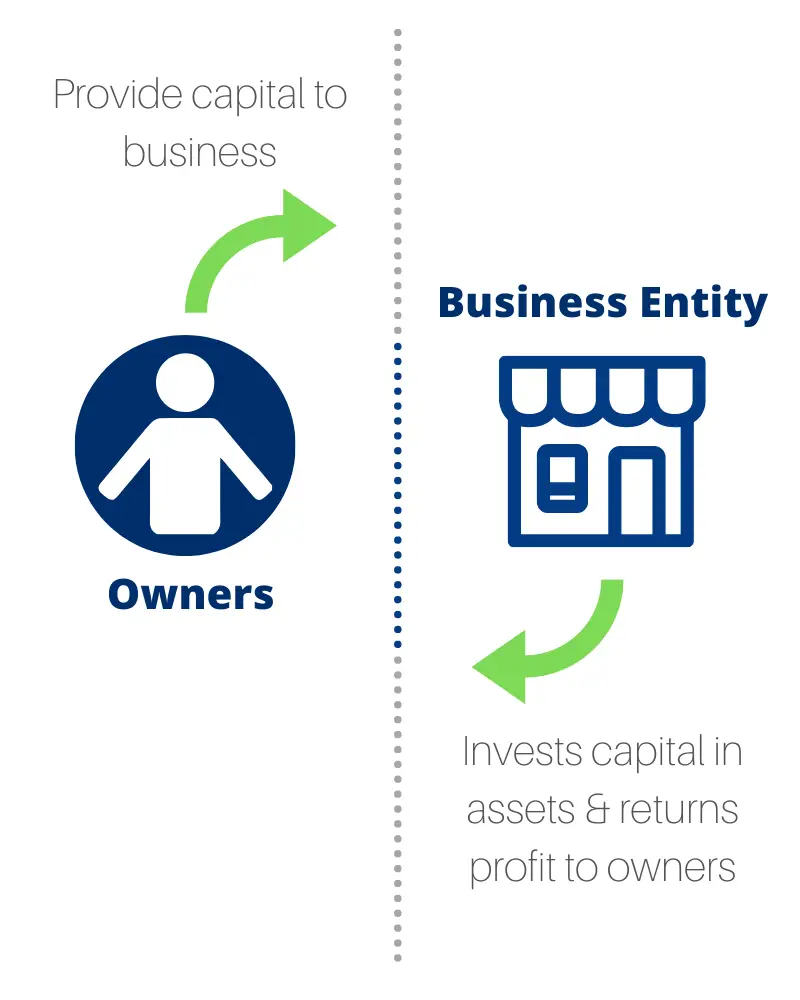

As per this concept, the financial transactions pertaining to the business entity should be recorded separately from the business owner’s transactions. A general partnership is an agreement between two or more business individuals. Each partner contributes capital, whether money, skills, or labor, and they share profits and losses based on predetermined terms. Like a sole proprietorship, a general partnership involves unlimited liability, meaning partners are personally accountable for the company’s debts. The business entity concept asserts that a company’s assets, liabilities, revenue, and expenses should be managed independently of the owners’ assets, liabilities, income, and expenses. This fundamental principle ties the concept of a distinct business entity to the accounting field. Similarly, as blockchain technology continues to evolve, a cs2 game art timeline can help players navigate the world of blockchain-based gaming. From understanding play-to-earn mechanics and NFT integration to choosing secure crypto wallets and decentralized gaming platforms, this guide provides insights into maximizing gaming rewards and ensuring safe transactions in the ever-expanding crypto gaming ecosystem..

How Business Entities Work

So reporting to the nearest $000 or $m instead of the nearest $, will often still allow informed decisions to be made. In case it turns out that the types of business entity chosen were not suitable after a period of time, entrepreneurs should consider changing them to avoid any serious problems that may arise from this situation. It is essential to check what types of business entities are available and which ones you will be able to choose from.

Business Entity Concept in Accounting

We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. A business exists primarily to produce goods and services at minimum cost and then sell them for a profit.

History and evolution of the different types of business entities

For instance, it should be possible for users to understand how a business has performed in the year by comparing it to the results of the previous year. This is only possible if the figures and information are prepared using consistent methods across each year. Consistency across entities means that it should be possible to compare one business’s performance with a competitor and therefore make informed investment decisions. Consistency is a straightforward principle and is intended to enhance financial reporting by making it easier for users to make comparisons.

It also protects its members from personal liabilities for company debts up to their contribution, unlike Limited Partnership, where partners are liable for all types of debts incurred by the business. It has a similar advantage to how to make an invoice C Corp in terms of liability, where shareholders are not liable for the company’s debt up to their contribution. Still, it also allows more types of financial arrangements like limited partners in the case of Limited Partnership.

Partnerships

According to the business entity principle, the owner’s financial transactions and those of the business are treated as separate entities. This means the owner’s assets and liabilities are distinct from the company’s records. However, a drawback of sole proprietorship is the concept of unlimited liability. If the company goes bankrupt, the owner is personally responsible for settling the company’s debts from their personal assets. The business entity principle focuses on financial separation, not legal liability.

- It means that the business’s finances are distinct and independent of the owner’s personal finances.

- The business entity concept improves the financial record-keeping efficiency of a business.

- The business entity concept, also known as the entity concept or separate entity concept, is a fundamental accounting principle that treats a business as a distinct and separate entity from its owners or shareholders.

- He has setup a single-member accounting practice and uses one room for the purpose of business.

- Expense on education that is necessary for self-employed owners to improve their knowledge and understanding of their trade is considered a business expense in accounting.

11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. In addition to the managers, there are employees and workers who perform specific tasks under the overall supervision of the owners or managers. All of this can be explained by considering the transaction that was included in the discussion on accruals.

An illustrative example of the business entity principle involves a business owner borrowing money from their company to fund their child’s education. Since this entails using business funds, this withdrawal is not classified as a business expense. A company owner personally acquires an office building and rents space within it to the company for $5,000 per month. From the company’s perspective, this rent payment is a legitimate business expense, whereas, for the owner, it constitutes taxable income.

Under the business entity concept, there is a reduction of $10,000 in equity highlighted in the organization’s accounting records and a corresponding $10,000 of taxable income issued to the shareholders. It requires creating separate financial records for all transactions for the business and its partner owners. Under the business entity concept, it is assumed that for the purpose of accounting practices, businesses and their owners are two separate entities. Accountants should only record the affairs of the business and not the personal affairs of the owners.

The best type of business entity to choose depends on the type and nature of your business and the number of owners. It’s one of the most key decisions that business owners can make, so it’s best to consult tax and legal professionals for advice specific to your business. The business entity concept states that your business transactions be recorded as a separate entity from the personal affairs and financial decisions of the business owner or other businesses. In accounting, the business entity concept prevents personal and business expenses from becoming entangled, interfering in determining the correct taxable information. Any money moving to or from the company should be recorded in a separate accounting journal to avoid confusion. The business entity principle simply means that, for the purpose of maintaining accounting records, the business is treated as a separate entity from the owner(s) of the business.

At the same time, the owners may face individual income tax rates on any profits distributed to them. The business entity principle requires each business to be treated separately from its owners for accounting purposes. Personal activities of the owners are kept separate from the business transactions and excluded from the financial statements. Businesses are organized either as a sole proprietorship, a partnership or a corporation. While the owners are quite distinct from the business in case of a corporation, they are one and the same in the case of sole proprietorship.